CA Intermediate Classes

September 2024/January/May 2025

As per the New Scheme of Education and Training 2023, the CA Intermediate course is a pivotal phase in the journey towards becoming a Chartered Accountant, following successful completion of the CA Foundation level.

Administered by the Institute of Chartered Accountants of India (ICAI), the Intermediate course is designed to deepen the understanding of accounting principles, financial management, and taxation.

The course comprises two groups, each consisting of 3 subjects, providing a comprehensive study of advanced accounting, corporate laws, audit and assurance, strategic management, and more.

The Intermediate level acts as a bridge, refining the technical and practical skills of aspiring Chartered Accountants as they progress towards the final stage of their qualification.

Admission Open

Yashotsav Offer

Note: The final prices reflect discounts applied from the original prices.

Repeaters Classes Sep 24 Exams

Note: The final prices reflect discounts applied from the original prices.

CA Inter Online Classes

Why IGP for CA Intermediate Classes?

To become a CA, a student goes through diligent efforts and labor. It’s not easy and thats when the best coaching classes for CA Intermediate pops up. IGP Classes provides you with a number of benefits and all necessary training equipments that will help you to become a successful CA.

- Carefully Designed Study Material

- Blended Mode of Learning

- Numerous AIRs and Rank holders

- Friendly Environment for Students

- Personalised Guidance and Mentorship

- Sessions with Industry Experts

- Regular Tests and Revision Classes

Buy CA Intermediate Course Now

IGP Toppers

Modes of CA Intermediate Classes at IGP

| Face to Face/Live at Home | Recorded Pendrive/GD Classes |

|---|---|

| Register Now | Buy Now |

Free Demo Classes for Sep 2024/Jan/May 2025

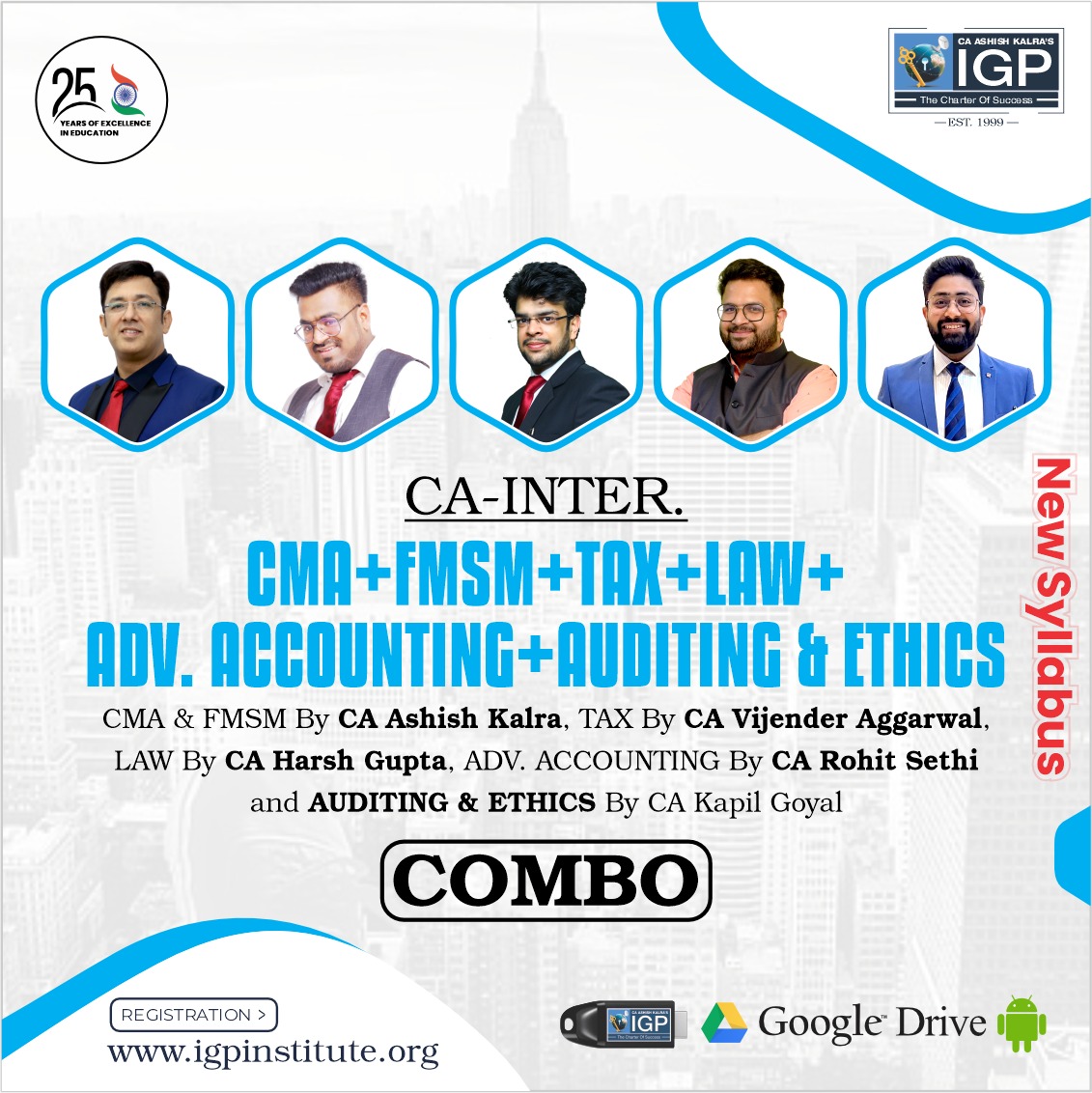

| Subject | Faculty |

|---|---|

| Group 1 | |

| Paper 1: Advanced Accounting | CA Rohit Sethi |

| Paper 2: Corporate & Other Laws | CA Harsh Gupta |

| Paper 3: Taxation | CA Vijender Aggarwal |

| Group 2 | |

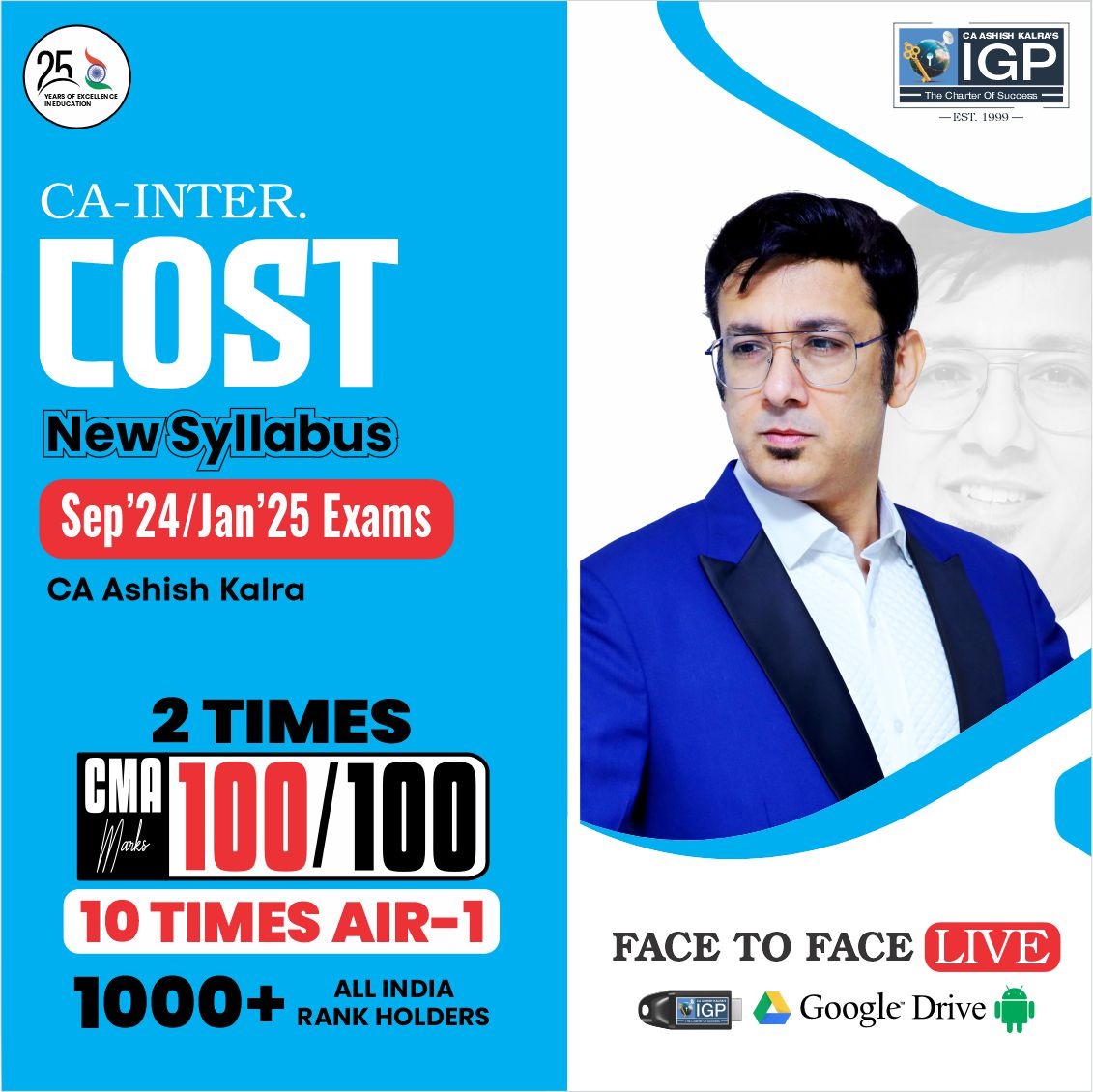

| Paper 4: CMA (Costing) | CA Ashish Kalra |

| Paper 5: Auditing & Ethics | CA Kapil Goyal |

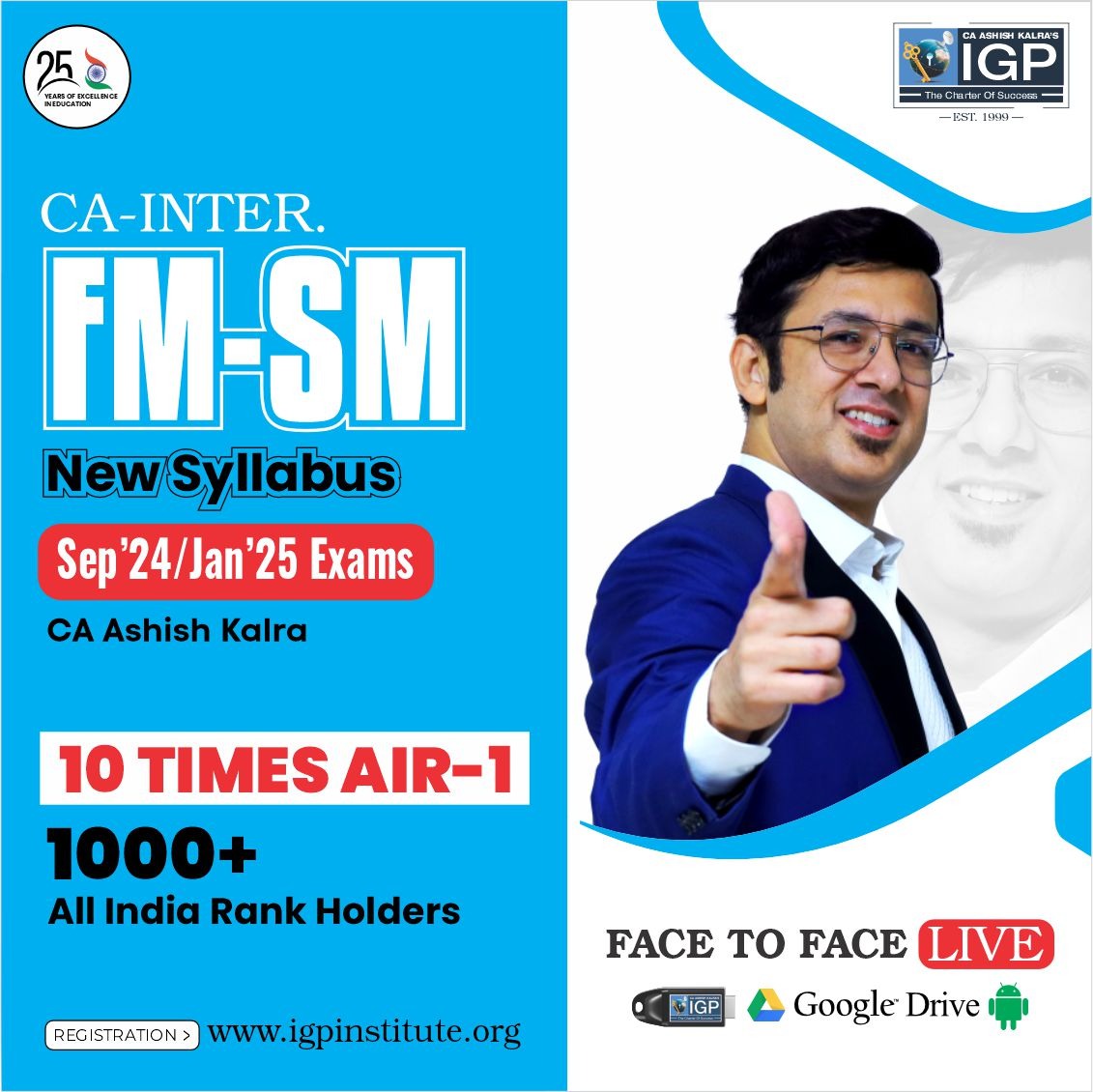

| Paper 6: FM SM | CA Ashish Kalra |

We provide detailed explanation of the subject matter and cover all the essential information that a student needs, have a look!

One distinguishing feature of the CA Intermediate course is its focus on building a strong foundation in both theoretical concepts and practical application. The curriculum is designed to expose candidates to real-world scenarios, enhancing their ability to analyze and solve complex financial problems.

Additionally, the CA Intermediate course places emphasis on professional ethics and values, aligning future Chartered Accountants with the ethical standards expected in the field. This holistic approach ensures that individuals completing the Intermediate level are not only academically proficient but also equipped to handle the ethical challenges that may arise in their professional careers.

CA Intermediate Eligibility for Sep 2024/Jan/May 2025

The candidates can register for the intermediate course through the following two routes:

- Through CA Foundation Course: Candidates who have qualified CA Foundation Examination conducted by the Institute of Chartered Accountants of India (with minimum 50% marks).

- Through Direct Entry Route:The following candidates are allowed to directly register for the CA Intermediate course:

- A Commerce graduate/ Post-Graduate (with minimum 55% marks) or Other Graduate/ Post-Graduate ( with minimum 60% marks)

- A candidate who has passed the Intermediate level exam conducted by the Institute of Company Secretaries of India or the Institute of Cost Accountants of India.

CA Intermediate Registration 2024

Intermediate course is divided into 6 subjects and 2 groups and Intermediate exams are held thrice in a year i.e., January, May and September.

The students who wish to appear in the May cycle should get themselves registered before 1st January, September cycle should get themselves registered before 1st May and the students who wish to appear in the January cycle should get themselves registered before 1st July.

Students from the CA foundation route can register themselves either for one group or both the groups of the intermediate course. However, the students from the direct entry route have to register themselves for both groups at a time.

Candidates who are pursuing the Final Year of Graduation Course can also register for the Intermediate Course on a provisional basis.

CA Intermediate Registration Fees 2024

| Particulars | Both Groups (Rs.) | Both Groups (US $) | Group I/ II (Rs.) | Group I/ II (US $) |

|---|---|---|---|---|

| Registration Fee | 15,000 | 11,000 | ||

| Students Activities Fees | 2,000 | 2,000 | ||

| Registration Fees as Articled Assistant | 1,000 | 2,000 | ||

| Total | 18,000 | 1,000 | 13,000 | 600 |

CA Intermediate Application Fees 2024

For May 2024 Attempt, exam forms are out in February 2024 and for Sep 2024 Attempt, exam forms are out in August 2024 and for January 2025 Attempt, exam forms are out in April.

| For Both Groups | For Single Group | |

|---|---|---|

| For Indian Centres | INR 2700 | INR 1500 |

| For Kathmandu (Nepal) Centre | INR 3400 | INR 2200 |

| For Overseas Centres (Abu Dhabi, Doha, Dubai, Muscat) | US $500 | US $ 325 |

Exam Pattern for Sep 2024/Jan/May 2025

CA intermediate course consists of 6 subjects- Advanced Accounting, Corporate and Other Laws, Taxation, Cost and Management Accounting, Auditing and Ethics, Financial and Strategic Management.

Each paper will carry 100 marks and a duration of 3 hours.

Each paper will include multiple choice questions and descriptive questions. For MCQs, 30 marks will be allotted while the remaining 70 marks are for descriptive questions.

CA Intermediate Exam Course for Sep 2024/Jan/May 2025

As described, the 6 subjects of CA Intermediate course are divided into 2 groups-

Group 1- Advanced Accounting + Corporate and other laws + Taxation

Group 2- Cost and management accounting + Auditing and ethics + Financial and strategic management

Objective- to acquire the ability to apply specific accounting standards and legislations to different transactions and events and in preparation and presentation of financial statements of various business entities.

- Chapter 1: Introduction to Accounting Standards

- Chapter 2: Framework for Preparation and Presentation of Financial Statements

- Chapter 3: Applicability of Accounting Standards

- Chapter 4: Presentation & Disclosures Based Accounting Standards

- Chapter 5: Assets Based Accounting Standards

- Chapter 6: Liabilities Based Accounting Standards

- Chapter 7: Accounting Standards Based on Items Impacting Financial Statement

- Chapter 8: Revenue Based Accounting Standards

- Chapter 9: Other Accounting Standards

- Chapter 10: Accounting Standards for Consolidated Financial Statement

- Chapter 11: Financial Statements of Companies

- Chapter 12: Buyback of Securities

- Chapter 13: Amalgamation of Companies

- Chapter 14: Accounting for Reconstruction of Companies

- Chapter 15: Accounting for Branches including Foreign Branches

Objective- To develop an understanding of the legal provisions and acquire the ability to analyse and apply the laws in practical situations.

PART I - COMPANY LAW AND LIMITED LIABILITY PARTNERSHIP LAW

- Chapter 1: Preliminary

- Chapter 2: Incorporation of Company and Matters Incidental Thereto

- Chapter 3: Prospectus and Allotment of Securities

- Chapter 4: Share Capital and Debentures

- Chapter 5: Acceptance of Deposits by Companies

- Chapter 6: Registration of Charges

- Chapter 7: Management & Administration

- Chapter 8: Declaration and Payment of Dividend

- Chapter 9: Accounts of Companies

- Chapter 10: Audit and Auditors

- Chapter 11: Companies Incorporated Outside India

- Chapter 12: The Limited Liability Partnership Act, 2008

PART I - COMPANY LAW AND LIMITED LIABILITY PARTNERSHIP LAW

- Chapter 1: The General Clauses Act, 1897

- Chapter 2: Interpretation of Statutes

- Chapter 3: The Foreign Exchange Management Act, 1999

This paper is further divided into 2 sections- Income tax and Goods and services tax.

Objective- To develop an understanding of the provisions of income-tax law and GST Law whereas to acquire the ability to apply such provisions to solve problems and address application oriented issues.

Section A: Income-tax Law

- Chapter 1: Basic Concepts

- Chapter 2: Residence and Scope of Total Income

- Chapter 3: Heads of Income

- Chapter 4: Income of Other Persons included in Assessee’s Total Income

- Chapter 5: Aggregation of Income, Set-Off and Carry Forward of Losses

- Chapter 6: Deductions from Gross Total Income

- Chapter 7: Advance Tax, Tax Deduction at Source and Tax Collection at Source

- Chapter 8: Provisions for filing Return of Income and Self Assessment

- Chapter 9: Income Tax Liability – Computation and Optimisation

Section B: Goods and Services Tax

- Chapter 1: GST in India – An Introduction

- Chapter 2: Supply under GST

- Chapter 3: Charge of GST

- Chapter 4: Place of Supply

- Chapter 5: Exemptions from GST

- Chapter 6: Time of Supply

- Chapter 7: Value of Supply

- Chapter 8: Input Tax Credit

- Chapter 9: Registration

- Chapter 10: Tax Invoice; Credit and Debit Notes

- Chapter 11: Accounts and Records

- Chapter 12: E-Way Bill

- Chapter 13: Payment of Tax

- Chapter 14: Tax Deduction at Source and Collection of Tax at Source

- Chapter 15: Returns

Objective- To develop an understanding of the basic concepts and applications to establish the cost associated with the production of products and provision of services and apply the same to determine prices and to develop an understanding of cost accounting statements.

- Chapter 1: Introduction to Cost and Management Accounting

- Chapter 2: Material Cost

- Chapter 3: Employee Cost and Direct Expenses

- Chapter 4: Overheads – Absorption Costing Method

- Chapter 5: Activity Based Costing

- Chapter 6: Cost Sheet

- Chapter 7: Cost Accounting Systems

- Chapter 8: Unit & Batch Costing

- Chapter 9: Job Costing

- Chapter 10: Process & Operation Costing

- Chapter 11: Joint Products and By Products

- Chapter 12: Service Costing

- Chapter 13: Standard Costing

- Chapter 14: Marginal Costing

- Chapter 15: Budgets and Budgetary Control

Objective- To develop an understanding of the concepts in auditing and of the generally accepted auditing procedures, techniques and skills and acquire the ability to apply the same in audit and attestation engagements.

- Chapter 1: Nature, Objective and Scope of Audit

- Chapter 2: Audit Strategy, Audit Planning and Audit Programme

- Chapter 3: Risk Assessment and Internal Control

- Chapter 4: Audit Evidence

- Chapter 5: Audit of Items of Financial Statements

- Chapter 6: Audit Documentation

- Chapter 7: Completion and Review

- Chapter 8: Audit Report

- Chapter 9: Special Features of Audit of Different Type of Entities

- Chapter 10: Audit of Banks

- Chapter 11: Ethics and Terms of Audit Engagements

This paper is further divided into 2 sections- Financial management and strategic management.

Objective- To develop an understanding of various aspects of Financial Management and acquire the ability to apply such knowledge in decision-making, to understand various finance functions like financing decision, investment decision, dividend decisions and to develop an understanding of strategic management concepts and techniques and acquire the ability to apply the same in business situations.

Section A: Financial Management

- Chapter 1: Scope and Objectives of Financial Management

- Chapter 2: Types of Financing

- Chapter 3: Financial Analysis and Planning – Ratio Analysis

- Chapter 4: Cost of Capital

- Chapter 5: Financing Decisions – Capital Structure

- Chapter 6: Financing Decisions – Leverages

- Chapter 7: Investment Decisions

- Chapter 8: Dividend Decision

- Chapter 9: Management of Working Capital

Section B: Strategic Management

- Chapter 1: Introduction to Strategic Management

- Chapter 2: Strategic Analysis: External Environment

- Chapter 3: Strategic Analysis: Internal Environment

- Chapter 4: Strategic Choices

- Chapter 5: Strategy Implementation and Evaluation

CA Inter FM SM Classes Details

CA Intermediate Admit Card

As we know that CA Intermediate examinations will commence from Sep 2024 so admit cards will be available on the official website of ICAI. All the candidates can download admit cards from the official website by using their registration number and password.

CA Intermediate Results

ICAI will release the CA Intermediate exam results within a month or two after the exams are conducted.

Frequently Asked Questions - CA Intermediate

Ques 1. What is some useful advice for a CA Intermediate student?

One of the foremost thing required for a CA Intermediate student is that he/she needs to make a proper study plan/timetable for self because that will help him/her to stay focused and disciplined and also keep track of the syllabus. Rest he/she needs to practice regularly, indulge in workout and meditation, daily revision and stay positive.

Ques 2. How should I study to get a rank in CA Intermediate?

In order to become a rank holder in CA Intermediate Exams, you should work upon on writing and presentation skills where quoting certain sections appropriately can fetch you additional marks and always try to make your own notes while study, that will help you to revise and regularly analysing your performance through mock tests is a great way to rectify where you are going wrong.

Ques 3. Which is the most scoring subject in CA Intermediate?

Now with 30 marks of MCQs with no negative marking, the level of CA Intermediate exams has become easier and with ICAI’s approach towards including more and more practical concepts and case studies in the syllabus, CA Intermediate has become more scoring than before.

Ques 4. Which classes should I join for CA Intermediate?

Promptly, IGP Classes is the best coaching classes for CA Intermediate. With 25+ years of experience, 95% Student Success Rate, Finest Faculty, Meet and Greets with Industry Experts and Top Notch Classroom Environment, IGP Classes stands unbeatable in this field.

Ques 5. Which mistakes should I avoid making during my CA Intermediate journey?

Studying without a proper plan, not making efforts in presenting the answer, consulting with too many people, not doing enough practice, spending a lot of time on social media and most importantly constantly comparing yourself with your peers

Ques 6. Which is the best online coaching for CA Intermediate?

Undoubtedly, IGP Classes is the best online coaching for CA Intermediate. Studying online has its own limitations that teachers are not present physically, no quick doubt resolutions etc but with IGP Classes you can sure of the services provided as we have a Dedicated Technical Support, Live chat options for students, Quick Query Resolutions and Direct Faculty Access.

Ques 7. When and How to register for CA Intermediate exams?

Registration for Intermediate exams begin from August for May attempt, February for September Attempt, and May for January Attempt.

Go to the official website of ICAI- www.icai.org and fill out the form with all necessary details and submit the documents. Pay the fees and your registration is completed.

Ques 8. What is the examination pattern of CA Intermediate under The New Scheme of Education and Training by ICAI?

There will be 30% case based MCQs and 70% descriptive questions in all six papers of Intermediate Exams.

Ques 9. What is the criteria of securing exemptions in subjects of CA Intermediate?

If a student has appeared in all the papers in a Group and fails in one or more papers but secures a minimum of 60% marks in any paper, he/she shall be exempted for that paper in which he/she has secured 60% or more marks for the immediately next three following examinations. The student will be required to obtain a minimum of 40% marks in each of the remaining papers and a minimum of 50% marks in the aggregate of all the papers including the exempted paper to pass the Group.

What Our Students

Say About Us

“ Having studied from Ashish Kalra sir in IPCC, I was absolutely sure to take my classes from him for CA Final too. The way he teaches the concepts, they get deeply engraved in us in a manner that it's ... “

MANVI DHINGRA

“ As the name suggests, IGP is an institute that really grooms professionals in true manner. Experience is not something which can be defined in words. It is a feeling and the feeling here at IGP with A... “

SHIVAM GOEL

“ Thank you sir, for converting our mistakes into lessons, pressures into productivity and skills into strength. You really know how to bring out the best in us. You are the answer to all our problems a... “

PRIYANSHI GARG

“ Sir, you are really awesome. I have never met you personally but ek ajeeb sa mental connection ho gaya hai aapse. I am taking your satellite classes in Agra. I can't even imagine what would be the sit... “

PARAS KALRA

“ ASHISH KALRA SIR, the most hardworking and sincere teacher I’ve ever met. IGP means awesome and the best institute for CA classes. I believe all my success is because of this hardworking teache... “

ABHISHEK BHARTI

“ The most important thing that I've learnt is to plan my work. ASHISH SIR has been a constant source of motivation who instills a lot of confidence in a person. I actually started believing, that achie... “

SASHA AGGARWAL

“ You are an awesome teacher by the way you teach. Your hard work to build our careers motivates us to work more till our last breath. You taught us not just Cost and FM, but also about all life aspects... “

HEMANT AGGARWAL

“ IGP is a place you can trust. I am very happy to be a part of this institute. CA Ashish Kalra is a great teacher and I am so blessed to be a part of his life which he shared with us while teaching us.... “

VISHAL KAPOOR

“ Experience of those four months with Ashish Kalra Sir was out of the world. A person who possesses such vast knowledge not only in the field of cost & F.M. but in other fields also, that we can dream ... “

AKSHAY JAIN

“ Ashish Sir is an amazing teacher. The way he introduces us with a concept, it make sure we never forget it. He has an explanation for every part of a concept, you just have to be a tentive and never g... “

ANSHIKA GOEL

“ it was a great experience studing from Ashish Sir. He always motivated us to give our best. He focused on concepts which really helped me in my revisions. His books are more than sufficient for exams ... “

DIVIJ CHADHA

“ Ashish sir is the best teacher anyone can get…. The way he teaches the concepts and clear each and every doubt is just amazing….. Studing Costing and FM from Ashish sir is just blessing ... “

Divya Jain

“ I was not able to clear only SCMPE for the last 2 times. But this time because of your classes, I crack it and become CA. Thanks a lot sir... “

ARPIT

“ I Scored 80 marks in SFM in yesterday result and I am a CA now so thanku sir for your guidance and effort.... “

ANURAG ARORA

“ Sir apke padhane ka tarika is out of level full conceptual clearity milti hai and theory padhane ka itna interesting way hai ki kabhi bore nahi hote…... Thanks for all such efforts you do for us... “

ANUBHAV THAKUR

“ Sir ji…. Apne Economics, FM, Cost itni easy tarah se padhaya ki sab samajh aa gya... Sir I Love You… you are the best teacher of this world thanks sir ji for this. ... “

ANSHUL VASHISTHA

“ Ashish sir apke jaisa teacher kabhi nahi mila aur shayad kabhi milega bhi nahi. Sir u r the best…... And apke concept batane ki technique is simply awsome. According to my family and friends I c... “

ANKIT KUMAR

“ Best faculty for CA and only institute with face to face classes. Energy level is so high. Motivational lectures are awsome. Best books and content fully covered. Fun and knowledge together. ... “

AMAN SAXENA

“ Choosing Ashish Sir as mentor was one of the decisions I am proud of, beside his extreme knowledge and ability to disseminate it, his hardwork for us was indeed selp motivating. Now to elobrate on stu... “

DUSHYANT GARG

“ Words are too little to express what you are to me. You are the most invaluable part of my life and play multiple roles. But it was a teacher that you first exercised your influence on me. So on the o... “

ETI Agarwal

“ The Ashish Kalra Sir u have been so much more than a teacher for us…. (mentor, guide, friend) I can challenge anybody in the whole world to find a better teacher than u…. U have set a grea... “

Himanshi Goel

“ Ashish Kalra Sir YOU ARE THE BEST, I still remember the first day of class when all questions seemed same and confusing to me and last day when I was able to handle them proficiently. You made CMA lik... “

Isha

“ Ashish Kalra Sir, You are the Best, I still remember before the first day of class when everything was new and tough in my mind, since the first day till the last day everything was easy as a cakewalk... “

Ishita

“ The experience of taking classes from Ashish Sir is magical, something that cannot be accurately described in words. Although I took a pendrive classes, I never felt disconnected and it was as if I wa... “

Mahin Naim

“ Sir, you have been an excellent teacher, hardworking and devoted to your work and to us. You have helped us grasp your subject through intresting lectures and presentations, feeling us up to achieve o... “

Mittul Garg

“ Ashish sir is the one who takes a hand opens a mind and touches the heart. He is the best inspiration one can get He is the best teacher one can get. ... “

Neha Tayal

“ Sir… you are the best teacher no one can teach Cost, FM & ECO for finance better than you….. This whole market is full of teachers but you are diamond of the field and your book of economi... “

Nikhil Arora

“ Give your best and you will definitely get the best. Keep on working hard and you will clear your CA Exams with good marks. This is what I did. I make a schedule and tried to follow it. Sir always use... “

Prachi Jain

“ The great instiute, where students are empowerd with knowledge and wisdom. CA Ashish Kalra Sir is DRONNACHARYA of CA students, in their classes knowledge flows like water is flowing in the river. He w... “

Satpal Singh

“ It has been a great expereince studing CMA & FM Eco from you Ashish Sir. I am so lucky that I got a teacher like you. Your teaching method is really simple, straight forward and effective and I will n... “

Shivam Malhotra

“ Ashish Kalra Sir has an impeccable talent of bringing the best out of his students. Further his questioning attitude and the method of developing the concepts is something which not only makes the sub... “

Vijender Aggarwal - 2 Times AIR-1

“ The experience of taking classes from CA Ashish Kalra Sir was amazing. He is the most hardworking person I have ever seen. The positivity and energy level which he passes to his students is simply a... “

Shubham Malhotra-AIR-1-CMA Marks 100/100

“ It was an amazing experience attending Kalra sir's classes. A great extent of this achievement of mine is owed to sir. The flawlessness of his teaching and the passion with which he teaches are someth... “

Bhumika Agarwalla-AIR-1-CFM Marks

“ I am Abhishek Agarwal, I secured All India 2nd rank in the CA-IPCC Nov’15 exams and got 82 marks in CFM. Talking about CA Ashish Kalra Sir I think he is a person who not only possesses the most... “

Abhishek AgarwaL-AIR-2-CFM Marks 82/100

“ I feel lucky that I got chance to be taught by CA Ashish Kalra Sir. To attend his class was quite a fabulous experience for me. He is the best teacher, mentor and guide I have ever seen. He makes ever... “

Pramanshu Sharma-AIR-3-CFM MARKS 88/100

“ "Teaching at its very best is what describes CA Ashish Kalra sir and CA Vijender Aggarwal sir. They both are extraordinary teachers. Their teaching style makes them stand out among others. They put ... “

AISHNIT KAUR-AIR-4

“ "The first coaching that I took was Cost and FM. It was a really great experience with sir. Everyday we came, the class comprised half of learning and half of motivation. We always had our fire burn... “

Aekansh Jain-AIR-4

“ "The experience of those 5 months with CA Ashish Kalra Sir was a life transforming journey. The main thing that is required in CA exams is Conceptual understanding. Sir's classes were a perfect blen... “

Shubham Agarwal-AIR-5

“ "It's a matter of great pride for me to achieve these goals and in reaching these milestones, IGP played a very important role for me. Be it CPT, IPC or Final, at all the levels all the faculty prov... “

Pragati Varshney-AIR-7-CFM Marks 94/100

“ Scored 100/100 in CMA and couldn’t have achieved it without Ashish sir. I used to keep contacting him regarding my doubts and at times when I was tensed. He used to be always there for me to guide ... “

Muskan Vadhera-CMA Marks 100/100

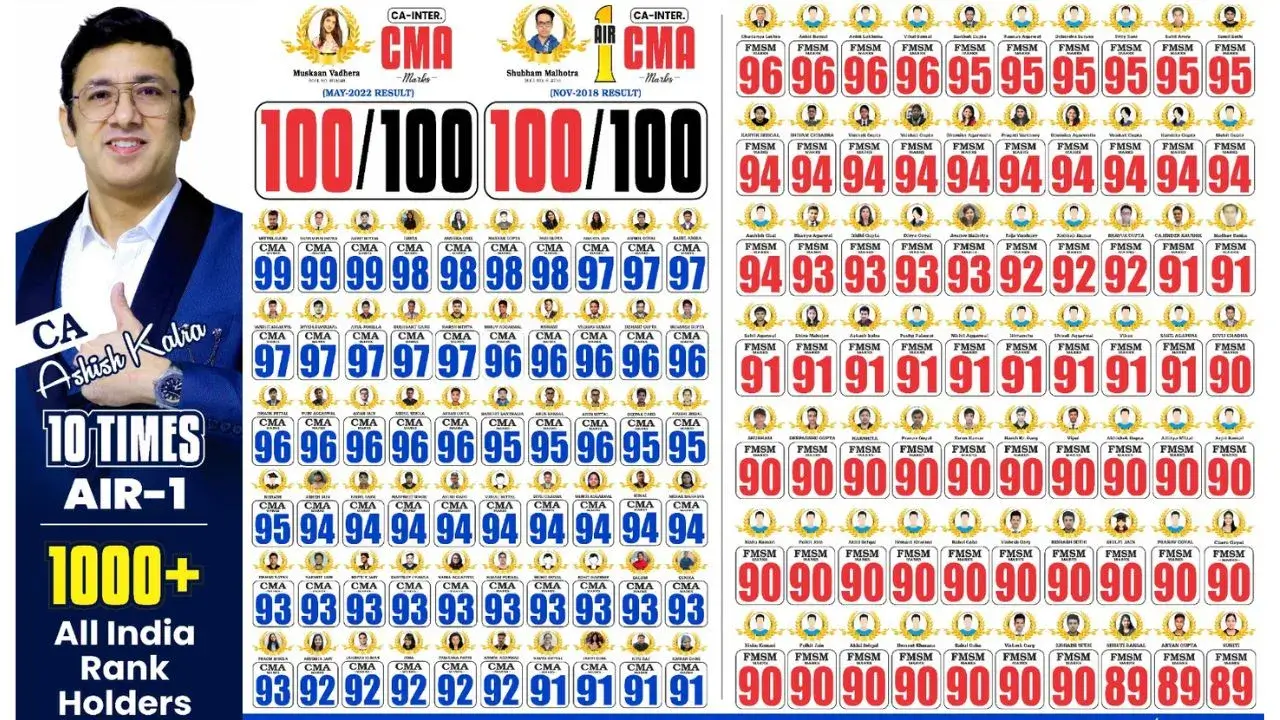

Our Achievements

250000

Students Enrolled

200

Top Class Products

2000

Ranks

10

AIR 1