Best CA Classes

CA Foundation | CA Inter | CA Final

Chartered Accountancy (CA) is one of the most renowned and a sought-after career profession with tremendous growth for all its innumerable students and members alike, both in India and abroad.

Chartered Accountant is an appellation, per se rendered to an accounting professional who has earned for himself a certification from a statutory body, the Institute of Chartered Accountants of India (ICAI) being the sole statutory body in India that was established in 1949 under the Chartered Accountants Act, 1949.

Get a Call Back

CA Course Classes Online/Offline

Get CA Foundation “Face to Face classes’, Live at Home/Center classes” as well as “Google drive/Pen drive classes”.

- Result Oriented Approach

- Interactive Learning Environment

- Parental Involvement

- Constructive Feedback to Students

Get CA Intermediate “Face to Face classes”, Live at Home/Center classes” as well as “Google drive/ Pen drive classes”.

- Comprehensive Study Material

- Alumni and Industry Experts Network

- Innovative Teaching Methods

- Personalised Attention

Get CA Final Google drive/

Pen drive classes.

- Expert Faculty

- User Friendly Platform with Technical Support

- Mock Tests and Assessments

- Accessible Resources

Why IGP for CA Classes in Delhi NCR?

Looking for CA Institutes with a proven track record of producing successful results, then IGP Classes is the answer. 10 times AIR 1 and 1000+ ranks makes us the ultimate king of the industry from past 25 years.

IGP Classes is also known for its students friendly services as well as experienced faculty, new age teaching methods, alumni network and Parental involvement and communication.

Modes of CA Classes at IGP

| Face to Face Classes | Live at home/center | Google Drive/Pendrive Classes |

|---|---|---|

| IGP Centres- Janakpuri, Rohini, Laxmi Nagar | Enquire Now | Buy Now |

CA Course Lectures

Reviews of IGP CA Students

Here are some of IGP’s recent toppers and rank holders in CA exams. Have a look what they have to say about us.

CA Found. Delhi Topper: Tanya Garg

Dec 2023

CA Inter AIR 6: Vansh Garg

Nov 2023

CA Final AIR-19: Aakarsh Jha

Nov 2023

CA Final AIR-3: Prakhar Varshney

May 2023

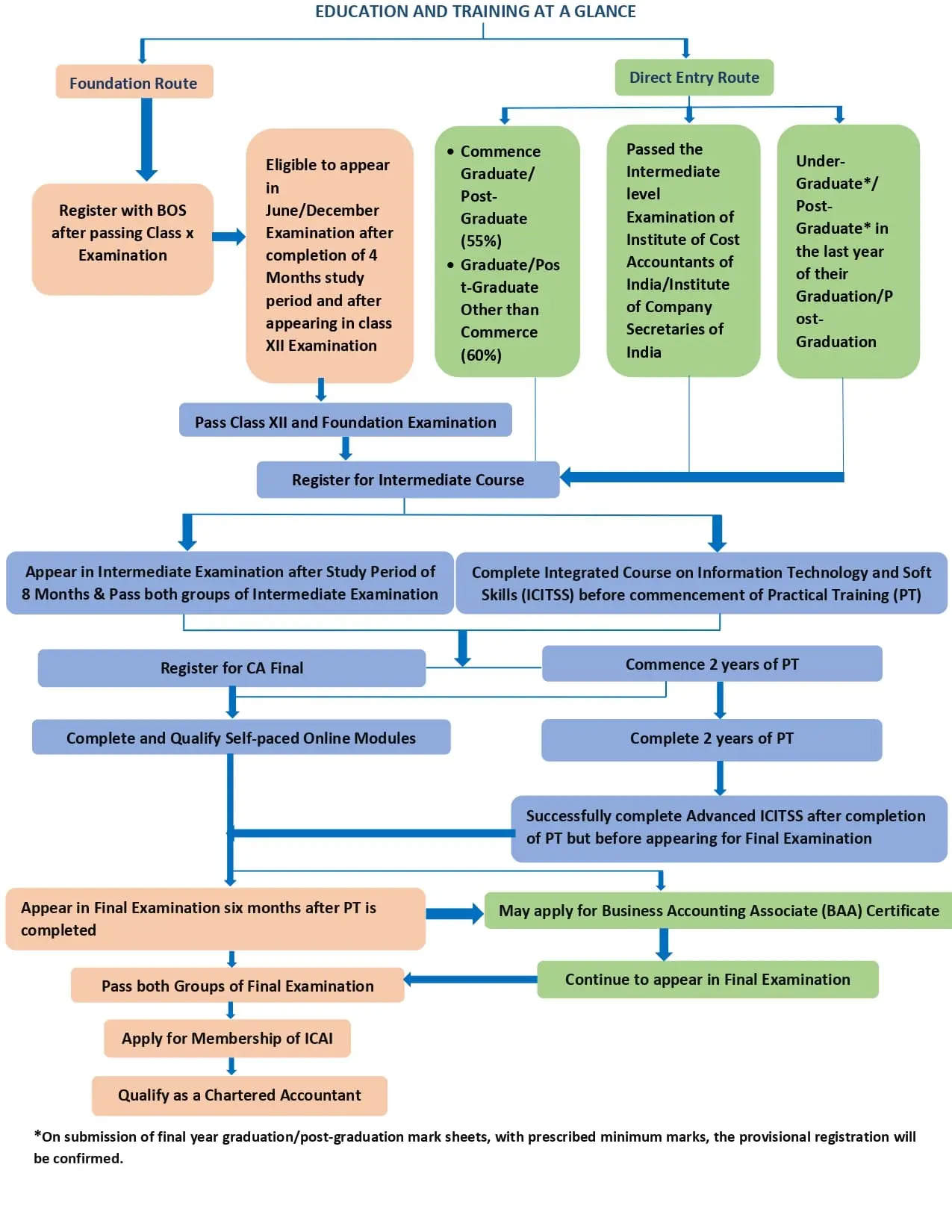

CA Course Eligibility for 2024 Examination

Frequently Asked Questions - CA Course

Ques 1. Which is the best coaching classes for CA Course in Delhi?

IGP Classes is the best coaching classes for CA course in Delhi. Quality education, experienced faculty, up to date study material and regular assessments help students in scoring the highest marks. With 10 times AIR 1 and 1000+ other rank holders, IGP classes is undoubtedly the prime choice of CA Students.

Ques 2. Should you go for Online or Offline classes for CA?

This depends on individual to individual. While offline or face to face classes is the traditional method of education, with technical revolution and modernisation, one can access the same education from any corner of the world.

With online classes, one gets the benefit of flexibility, comfort and having it own way but if someone wants in person interaction with peers and teachers as well as more structured studying pattern then offline classes is the best option for them. Ultimately, the decision depends on one’s learning style and preferences.

Ques 3. What is life like after becoming a CA?

Becoming a chartered accountant is a dream for thousands of students because you get a new identity, people around praise you, you become a role model for CA aspirants and you start feeling confident.

Not to forget, becoming a CA will open up numerous career opportunities and you can go to heights. It is the most demanding field in current times and value and respect of a chartered accountant is great.

Ques 4. Can I start CA after graduation?

Yes, one can start pursuing CA after graduation. The direct entry criteria is students who have done graduation or post graduation with a minimum of 55% marks or students with graduation or post graduation from other streams other than commerce with a minimum of 60% marks are eligible to apply directly for CA Intermediate examinations.

Ques 5. How much time it is required to be a CA?

A minimum of 5 years is required to be a CA. Firstly after completing 10+2, students will go for CA Foundation exams with a study period of 4 months.

Then comes the CA Intermediate exams which requires 8 months of study period and after clearing both groups, students will start with their articleship which will take another 2 years to complete and after completion of articleship and 6 months of ICITSS practical training, students will go for their CA Final exams and after clearing both groups, welcome to the CA Fraternity.

Ques 6. How to crack CA exams in first attempt?

Cracking CA exam is tough but can be achieved in first attempt. This requires persistence and grit. Choosing the right strategy is the main thing here. Know the complete exam pattern and create a sustainable time table. Regularly go through theory concepts, practice mock tests, make handwritten notes and try not to skip any topics.

Ques 7. Can I become a CA without commerce in class 12?

Yes you can become a chartered accountant without having studied commerce. You can enroll in CA after completing 10+2 in science or humanities field.

What Our Students

Say About Us

“ Having studied from Ashish Kalra sir in IPCC, I was absolutely sure to take my classes from him for CA Final too. The way he teaches the concepts, they get deeply engraved in us in a manner that it's ... “

MANVI DHINGRA

“ As the name suggests, IGP is an institute that really grooms professionals in true manner. Experience is not something which can be defined in words. It is a feeling and the feeling here at IGP with A... “

SHIVAM GOEL

“ Thank you sir, for converting our mistakes into lessons, pressures into productivity and skills into strength. You really know how to bring out the best in us. You are the answer to all our problems a... “

PRIYANSHI GARG

“ Sir, you are really awesome. I have never met you personally but ek ajeeb sa mental connection ho gaya hai aapse. I am taking your satellite classes in Agra. I can't even imagine what would be the sit... “

PARAS KALRA

“ ASHISH KALRA SIR, the most hardworking and sincere teacher I’ve ever met. IGP means awesome and the best institute for CA classes. I believe all my success is because of this hardworking teache... “

ABHISHEK BHARTI

“ The most important thing that I've learnt is to plan my work. ASHISH SIR has been a constant source of motivation who instills a lot of confidence in a person. I actually started believing, that achie... “

SASHA AGGARWAL

“ You are an awesome teacher by the way you teach. Your hard work to build our careers motivates us to work more till our last breath. You taught us not just Cost and FM, but also about all life aspects... “

HEMANT AGGARWAL

“ IGP is a place you can trust. I am very happy to be a part of this institute. CA Ashish Kalra is a great teacher and I am so blessed to be a part of his life which he shared with us while teaching us.... “

VISHAL KAPOOR

“ Experience of those four months with Ashish Kalra Sir was out of the world. A person who possesses such vast knowledge not only in the field of cost & F.M. but in other fields also, that we can dream ... “

AKSHAY JAIN

“ Ashish Sir is an amazing teacher. The way he introduces us with a concept, it make sure we never forget it. He has an explanation for every part of a concept, you just have to be a tentive and never g... “

ANSHIKA GOEL

“ it was a great experience studing from Ashish Sir. He always motivated us to give our best. He focused on concepts which really helped me in my revisions. His books are more than sufficient for exams ... “

DIVIJ CHADHA

“ Ashish sir is the best teacher anyone can get…. The way he teaches the concepts and clear each and every doubt is just amazing….. Studing Costing and FM from Ashish sir is just blessing ... “

Divya Jain

“ I was not able to clear only SCMPE for the last 2 times. But this time because of your classes, I crack it and become CA. Thanks a lot sir... “

ARPIT

“ I Scored 80 marks in SFM in yesterday result and I am a CA now so thanku sir for your guidance and effort.... “

ANURAG ARORA

“ Sir apke padhane ka tarika is out of level full conceptual clearity milti hai and theory padhane ka itna interesting way hai ki kabhi bore nahi hote…... Thanks for all such efforts you do for us... “

ANUBHAV THAKUR

“ Sir ji…. Apne Economics, FM, Cost itni easy tarah se padhaya ki sab samajh aa gya... Sir I Love You… you are the best teacher of this world thanks sir ji for this. ... “

ANSHUL VASHISTHA

“ Ashish sir apke jaisa teacher kabhi nahi mila aur shayad kabhi milega bhi nahi. Sir u r the best…... And apke concept batane ki technique is simply awsome. According to my family and friends I c... “

ANKIT KUMAR

“ Best faculty for CA and only institute with face to face classes. Energy level is so high. Motivational lectures are awsome. Best books and content fully covered. Fun and knowledge together. ... “

AMAN SAXENA

“ Choosing Ashish Sir as mentor was one of the decisions I am proud of, beside his extreme knowledge and ability to disseminate it, his hardwork for us was indeed selp motivating. Now to elobrate on stu... “

DUSHYANT GARG

“ Words are too little to express what you are to me. You are the most invaluable part of my life and play multiple roles. But it was a teacher that you first exercised your influence on me. So on the o... “

ETI Agarwal

“ The Ashish Kalra Sir u have been so much more than a teacher for us…. (mentor, guide, friend) I can challenge anybody in the whole world to find a better teacher than u…. U have set a grea... “

Himanshi Goel

“ Ashish Kalra Sir YOU ARE THE BEST, I still remember the first day of class when all questions seemed same and confusing to me and last day when I was able to handle them proficiently. You made CMA lik... “

Isha

“ Ashish Kalra Sir, You are the Best, I still remember before the first day of class when everything was new and tough in my mind, since the first day till the last day everything was easy as a cakewalk... “

Ishita

“ The experience of taking classes from Ashish Sir is magical, something that cannot be accurately described in words. Although I took a pendrive classes, I never felt disconnected and it was as if I wa... “

Mahin Naim

“ Sir, you have been an excellent teacher, hardworking and devoted to your work and to us. You have helped us grasp your subject through intresting lectures and presentations, feeling us up to achieve o... “

Mittul Garg

“ Ashish sir is the one who takes a hand opens a mind and touches the heart. He is the best inspiration one can get He is the best teacher one can get. ... “

Neha Tayal

“ Sir… you are the best teacher no one can teach Cost, FM & ECO for finance better than you….. This whole market is full of teachers but you are diamond of the field and your book of economi... “

Nikhil Arora

“ Give your best and you will definitely get the best. Keep on working hard and you will clear your CA Exams with good marks. This is what I did. I make a schedule and tried to follow it. Sir always use... “

Prachi Jain

“ The great instiute, where students are empowerd with knowledge and wisdom. CA Ashish Kalra Sir is DRONNACHARYA of CA students, in their classes knowledge flows like water is flowing in the river. He w... “

Satpal Singh

“ It has been a great expereince studing CMA & FM Eco from you Ashish Sir. I am so lucky that I got a teacher like you. Your teaching method is really simple, straight forward and effective and I will n... “

Shivam Malhotra

“ Ashish Kalra Sir has an impeccable talent of bringing the best out of his students. Further his questioning attitude and the method of developing the concepts is something which not only makes the sub... “

Vijender Aggarwal - 2 Times AIR-1

“ The experience of taking classes from CA Ashish Kalra Sir was amazing. He is the most hardworking person I have ever seen. The positivity and energy level which he passes to his students is simply a... “

Shubham Malhotra-AIR-1-CMA Marks 100/100

“ It was an amazing experience attending Kalra sir's classes. A great extent of this achievement of mine is owed to sir. The flawlessness of his teaching and the passion with which he teaches are someth... “

Bhumika Agarwalla-AIR-1-CFM Marks

“ I am Abhishek Agarwal, I secured All India 2nd rank in the CA-IPCC Nov’15 exams and got 82 marks in CFM. Talking about CA Ashish Kalra Sir I think he is a person who not only possesses the most... “

Abhishek AgarwaL-AIR-2-CFM Marks 82/100

“ I feel lucky that I got chance to be taught by CA Ashish Kalra Sir. To attend his class was quite a fabulous experience for me. He is the best teacher, mentor and guide I have ever seen. He makes ever... “

Pramanshu Sharma-AIR-3-CFM MARKS 88/100

“ "Teaching at its very best is what describes CA Ashish Kalra sir and CA Vijender Aggarwal sir. They both are extraordinary teachers. Their teaching style makes them stand out among others. They put ... “

AISHNIT KAUR-AIR-4

“ "The first coaching that I took was Cost and FM. It was a really great experience with sir. Everyday we came, the class comprised half of learning and half of motivation. We always had our fire burn... “

Aekansh Jain-AIR-4

“ "The experience of those 5 months with CA Ashish Kalra Sir was a life transforming journey. The main thing that is required in CA exams is Conceptual understanding. Sir's classes were a perfect blen... “

Shubham Agarwal-AIR-5

“ "It's a matter of great pride for me to achieve these goals and in reaching these milestones, IGP played a very important role for me. Be it CPT, IPC or Final, at all the levels all the faculty prov... “

Pragati Varshney-AIR-7-CFM Marks 94/100

“ Scored 100/100 in CMA and couldn’t have achieved it without Ashish sir. I used to keep contacting him regarding my doubts and at times when I was tensed. He used to be always there for me to guide ... “

Muskan Vadhera-CMA Marks 100/100

Our Achievements

250000

Students Enrolled

200

Top Class Products

1000

Ranks

10

AIR 1

.jpg)

.jpg)